Navigating Charleston County: A Guide to the Tax Map

Related Articles: Navigating Charleston County: A Guide to the Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Charleston County: A Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating Charleston County: A Guide to the Tax Map

- 2 Introduction

- 3 Navigating Charleston County: A Guide to the Tax Map

- 3.1 Understanding the Charleston County Tax Map

- 3.2 Exploring the Map’s Features

- 3.3 Navigating the Map: A Step-by-Step Guide

- 3.4 FAQs about the Charleston County Tax Map

- 3.5 Tips for Utilizing the Charleston County Tax Map

- 3.6 Conclusion

- 4 Closure

Navigating Charleston County: A Guide to the Tax Map

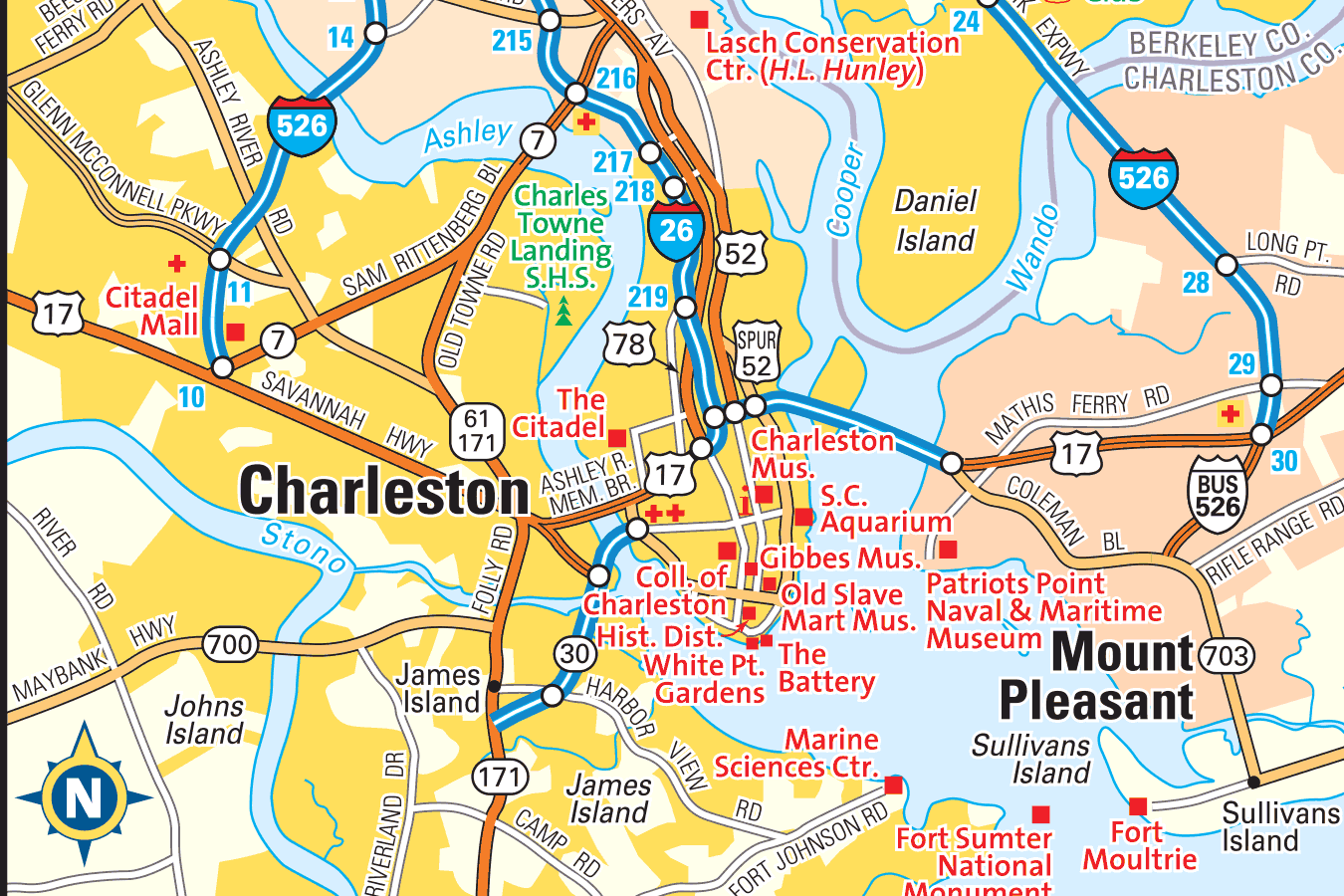

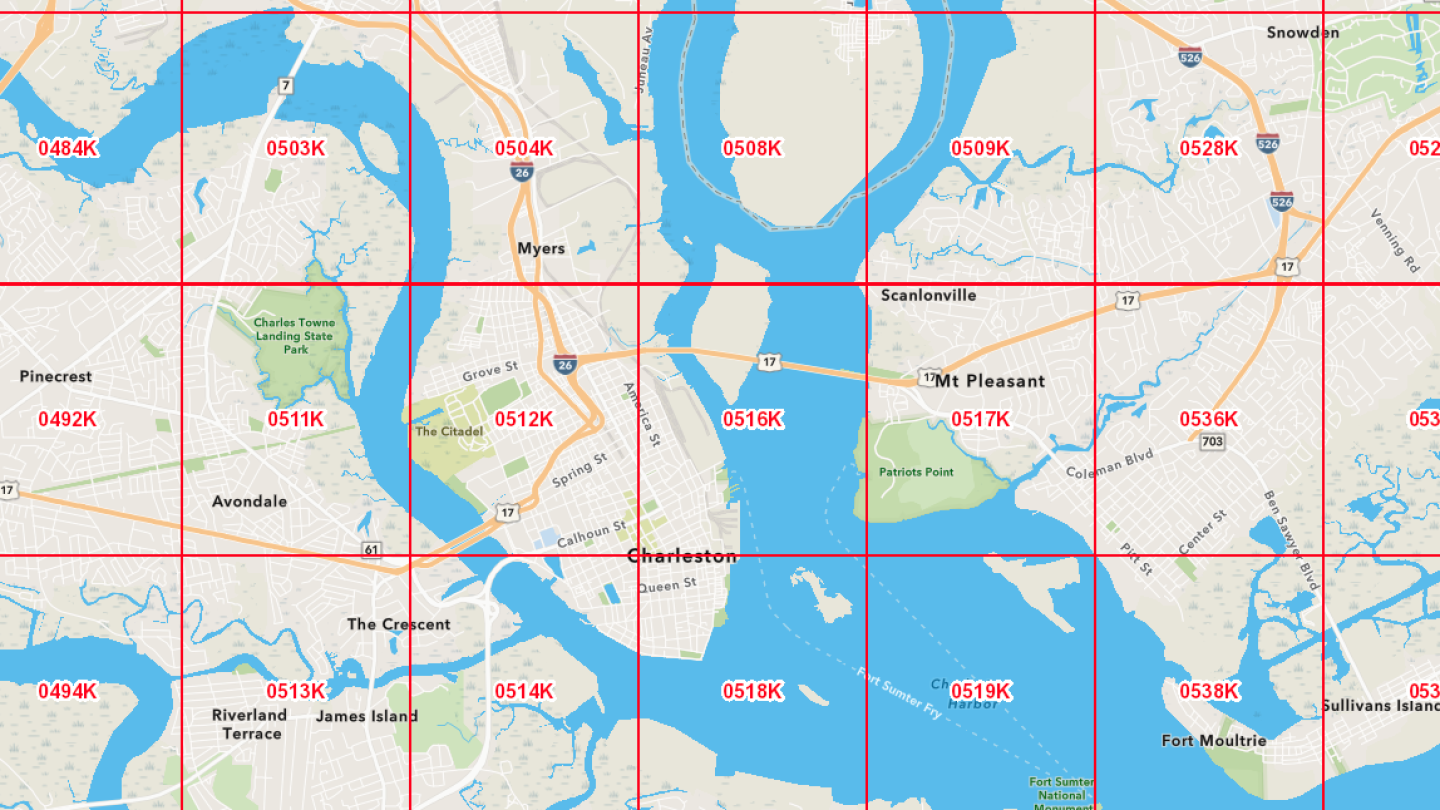

Charleston County, South Carolina, boasts a rich history, vibrant culture, and a diverse landscape. This blend of elements contributes to the county’s economic vitality and its appeal as a desirable place to live, work, and invest. However, navigating the intricacies of property ownership and understanding the county’s land use patterns requires a comprehensive tool. This is where the Charleston County Tax Map emerges as an indispensable resource.

Understanding the Charleston County Tax Map

The Charleston County Tax Map is a detailed, geographically referenced system that visually represents every parcel of land within the county’s boundaries. This map serves as a vital tool for various purposes, including:

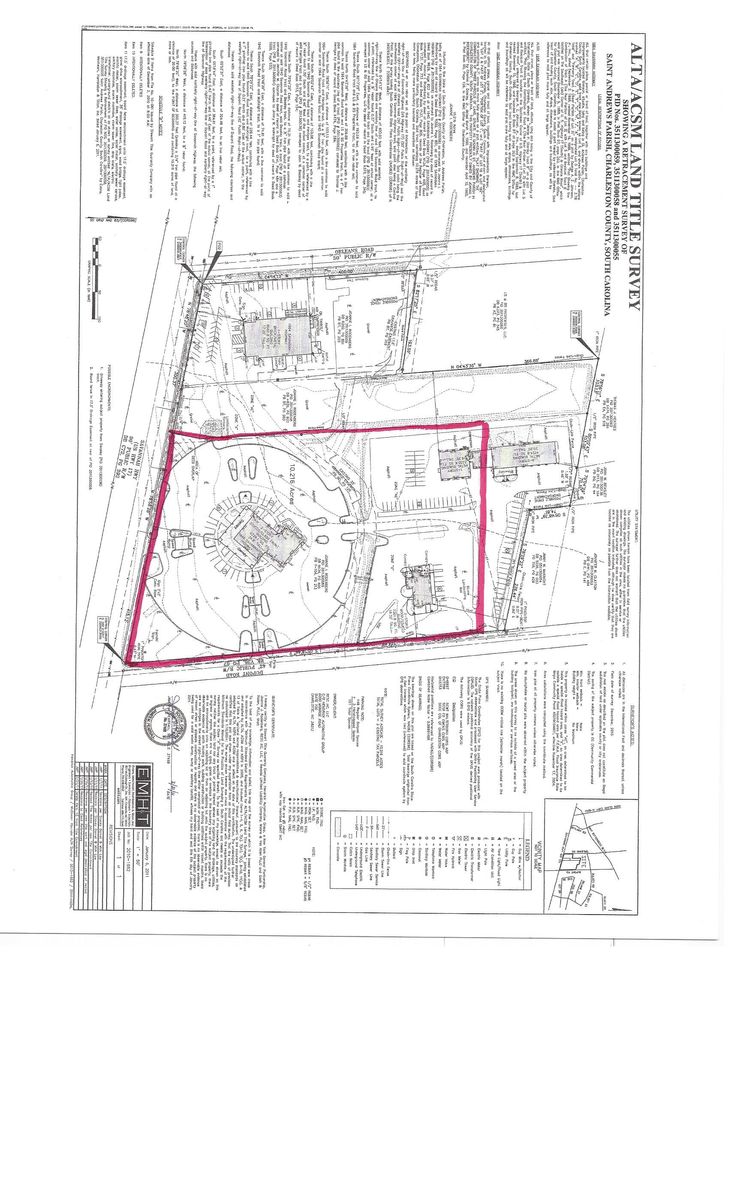

- Property Identification and Valuation: Each parcel is assigned a unique identification number, facilitating efficient property searches, assessments, and tax calculations.

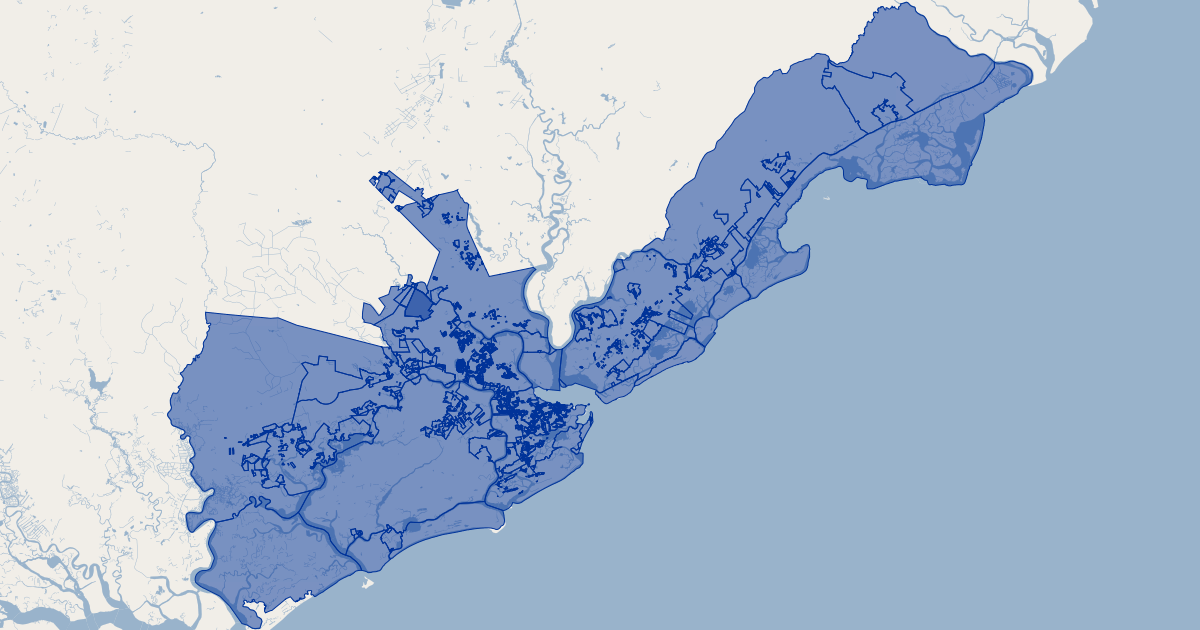

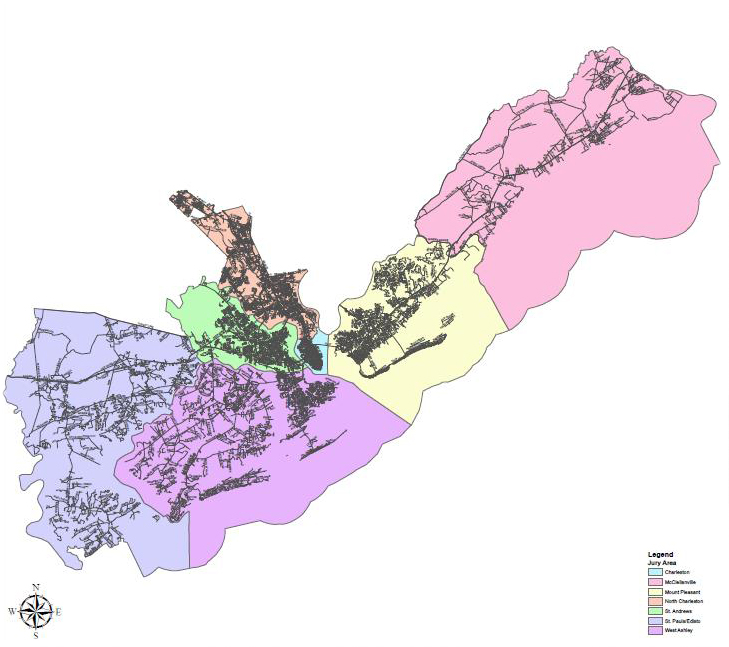

- Land Use Planning and Development: The map provides a clear picture of existing land uses, zoning regulations, and infrastructure, aiding in informed planning and development decisions.

- Property Transactions: The map plays a crucial role in real estate transactions, providing accurate information about property boundaries, ownership, and potential restrictions.

- Emergency Response and Disaster Relief: The map enables first responders to quickly locate properties and identify potential hazards, facilitating efficient emergency response and disaster relief efforts.

- Public Access and Transparency: The map serves as a public record, promoting transparency and accessibility to information about land ownership and use.

Exploring the Map’s Features

The Charleston County Tax Map is not merely a static visual representation. It is an interactive platform that offers a wealth of information through its various features:

- Interactive Map Interface: The map is accessible online, allowing users to zoom in and out, pan across different areas, and explore specific parcels of land.

- Data Layers: The map incorporates multiple data layers, including property boundaries, zoning districts, infrastructure networks, and environmental features, allowing users to analyze and interpret information based on their specific needs.

- Property Information Search: Users can search for specific properties using various criteria, such as parcel number, owner name, or address, retrieving detailed information about each property.

- Historical Data Access: The map often includes historical data, providing insights into land use changes, property ownership transitions, and development trends over time.

- Downloadable Data: Users can download data in various formats, such as shapefiles or spreadsheets, enabling further analysis and integration with other GIS systems.

Navigating the Map: A Step-by-Step Guide

Accessing and utilizing the Charleston County Tax Map is a straightforward process:

- Visit the Charleston County Government website: Locate the link to the Tax Map or GIS portal on the county’s official website.

- Select the desired map interface: The website may offer multiple map interfaces, including interactive online maps and downloadable data files.

- Explore the map’s features: Familiarize yourself with the various tools and features available, including zoom, pan, search, and data layers.

- Search for specific properties: Use the search function to locate properties based on parcel number, owner name, or address.

- Analyze property information: Access detailed information about each property, including its boundaries, zoning, assessed value, and ownership history.

FAQs about the Charleston County Tax Map

1. How do I find the parcel number for a specific property?

You can search for a property using the address or owner name. The map will display the parcel number associated with the property.

2. What information is available on the map about each property?

The map provides information about property boundaries, zoning, assessed value, ownership history, and other relevant details.

3. Can I download data from the map?

Yes, you can download data in various formats, such as shapefiles or spreadsheets.

4. How do I contact the Charleston County Assessor’s Office for assistance?

Contact information for the Assessor’s Office is usually available on the county’s website.

5. Is the map updated regularly?

The map is typically updated on a regular basis to reflect changes in property ownership, zoning, and other relevant data.

Tips for Utilizing the Charleston County Tax Map

- Familiarize yourself with the map’s features: Explore the map’s functionalities and tools to maximize its potential.

- Use the search function effectively: Utilize various search criteria to locate specific properties or areas of interest.

- Explore data layers: Analyze different data layers to gain a comprehensive understanding of land use, zoning, and other relevant information.

- Compare historical data: Access historical data to track changes in property ownership, zoning, and development patterns.

- Contact the Assessor’s Office for assistance: If you have any questions or need further assistance, contact the Charleston County Assessor’s Office for support.

Conclusion

The Charleston County Tax Map serves as a crucial resource for individuals, businesses, and government agencies alike. Its comprehensive data, interactive features, and accessibility make it an invaluable tool for navigating the complexities of property ownership, land use planning, and other critical aspects of county governance. By understanding and utilizing the map effectively, stakeholders can gain valuable insights, make informed decisions, and contribute to the continued growth and development of Charleston County.

Closure

Thus, we hope this article has provided valuable insights into Navigating Charleston County: A Guide to the Tax Map. We thank you for taking the time to read this article. See you in our next article!