The Map Rule Mortgage: Navigating the Complexities of Land Ownership

Related Articles: The Map Rule Mortgage: Navigating the Complexities of Land Ownership

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Map Rule Mortgage: Navigating the Complexities of Land Ownership. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Map Rule Mortgage: Navigating the Complexities of Land Ownership

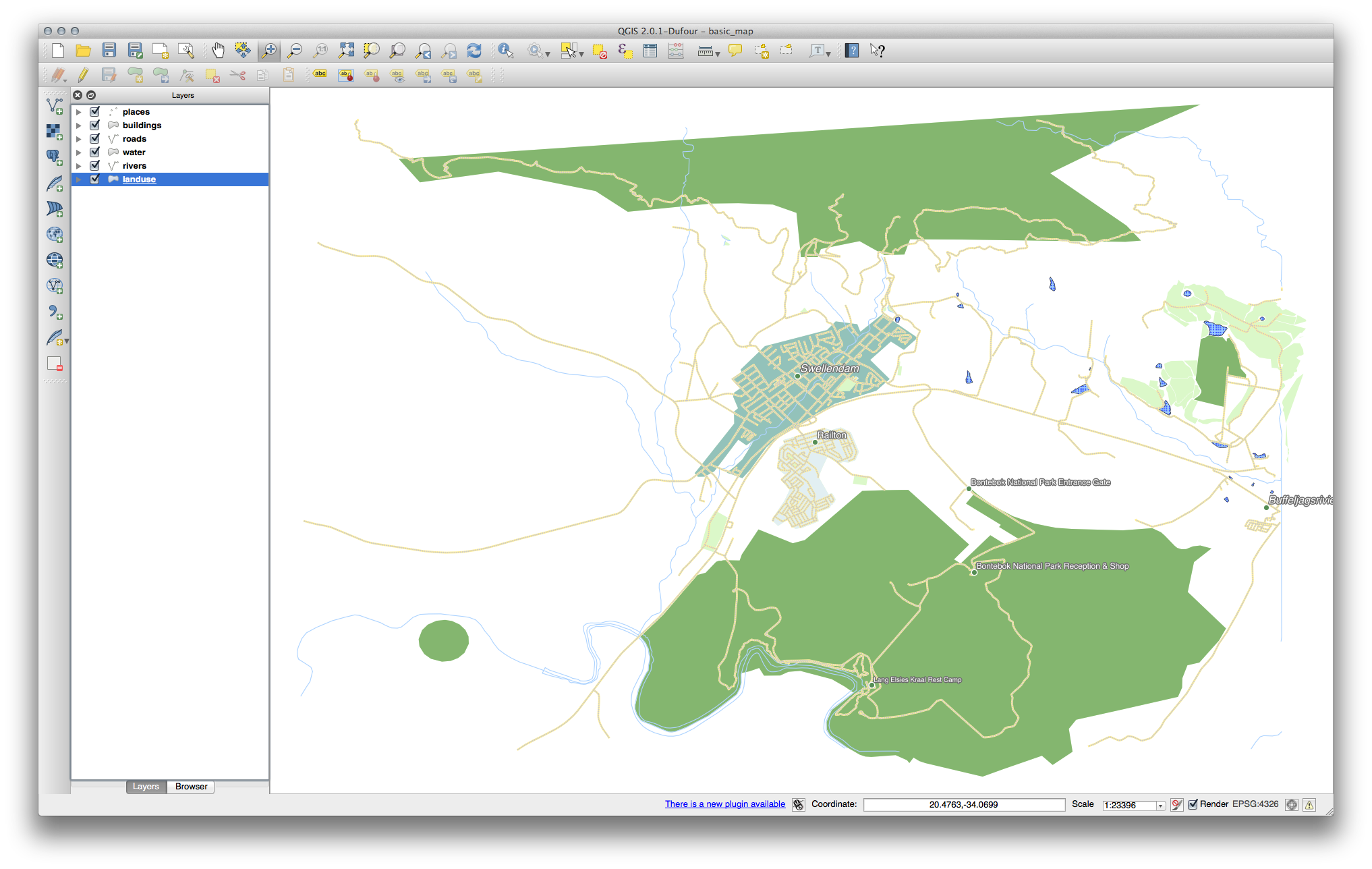

The concept of a "map rule mortgage" is a crucial element within the realm of real estate financing, particularly when dealing with properties subdivided from larger parcels. This rule, rooted in legal precedent, dictates how a mortgage lien attaches to specific portions of land within a larger subdivision. Understanding its intricacies is vital for both lenders and borrowers, as it can significantly impact the financial security of a transaction and the potential for future development.

Understanding the Map Rule’s Foundation

The map rule, also known as the "lot and block" system, originates from the practice of subdividing large tracts of land into smaller, more manageable units. These units are then assigned unique identifiers, typically represented by a lot number within a specific block, and are visually depicted on a recorded subdivision map. This map serves as the official legal document defining the boundaries and ownership of each individual lot.

The Key Principle: Lien Attachment

The map rule’s core principle lies in how a mortgage lien is attached to the property. When a mortgage is secured on a property subdivided under this system, the lien is considered to attach to the entire original parcel of land, not just the specific lot being financed. This means that if the borrower defaults on the mortgage, the lender has the right to foreclose on the entire original parcel, even if the mortgage was only intended to cover a single lot within that parcel.

Implications for Lenders and Borrowers

This rule has significant implications for both lenders and borrowers:

- Lenders: The map rule provides lenders with a more secure position in the event of a default. It ensures that they have recourse to the entire original parcel, potentially increasing the value of the collateral and offering greater protection against losses.

- Borrowers: While the map rule can provide financial security for lenders, it can pose challenges for borrowers. In the event of a default, the entire original parcel, including any developed lots, could be subject to foreclosure, even if the borrower only defaulted on a single lot.

Navigating the Challenges: The Importance of Clear Documentation

To mitigate potential risks, it is crucial for both parties to carefully review and understand the implications of the map rule:

- Lenders: Lenders must ensure that the subdivision map is properly recorded and that the mortgage document clearly identifies the specific lot being financed. They should also consider incorporating provisions within the mortgage agreement that address the potential for future development within the original parcel.

- Borrowers: Borrowers should carefully examine the subdivision map and mortgage documents to understand the scope of the lien and its potential impact on future development plans. They should also consult with legal counsel to ensure their rights are protected.

The Map Rule and Future Development

The map rule can pose significant challenges when it comes to future development within a subdivided parcel. For instance, if a developer wishes to build on a lot that is subject to a map rule mortgage, the lender’s consent may be required. The lender may demand a release of the lien on that specific lot, or they may require the developer to provide additional security or guarantees.

Addressing the Concerns: The Role of Legal Counsel

The complexities of the map rule highlight the critical role of legal counsel in real estate transactions. Attorneys can help ensure that all parties understand the implications of the map rule and can negotiate appropriate terms to protect the interests of both lenders and borrowers.

FAQs about the Map Rule Mortgage

1. Does the map rule apply to all mortgages?

No, the map rule only applies to mortgages secured on properties that were subdivided from a larger parcel and recorded on a subdivision map.

2. What happens if a lot within a subdivided parcel is sold?

When a lot is sold, the lien attached to the entire original parcel remains in place. The new owner of the lot inherits the mortgage obligation and the associated lien.

3. Can a lender release the lien on a specific lot?

Yes, a lender can release the lien on a specific lot if they are satisfied with the financial arrangements and the borrower’s ability to meet their obligations.

4. What are the potential risks for borrowers under the map rule?

Borrowers face the risk of losing the entire original parcel, including any developed lots, in the event of a default on the mortgage, even if the default only involves a single lot.

5. How can borrowers protect themselves from the risks associated with the map rule?

Borrowers should consult with legal counsel to understand the implications of the map rule and ensure their rights are protected. They should also consider negotiating terms with the lender to limit the scope of the lien or secure a release for specific lots.

Tips for Navigating the Map Rule Mortgage

- Thorough Due Diligence: Both lenders and borrowers should conduct thorough due diligence to ensure that the subdivision map is properly recorded and that the mortgage documents accurately reflect the intended scope of the lien.

- Clear Communication: Open and clear communication between lenders and borrowers is essential to avoid misunderstandings and potential disputes.

- Professional Guidance: Seek legal counsel to ensure that all parties understand the legal implications of the map rule and to negotiate appropriate terms to protect their interests.

- Future Planning: Consider potential future development plans when securing a mortgage under the map rule. Address these plans in the mortgage agreement and ensure that the lender’s consent is obtained if necessary.

Conclusion

The map rule mortgage is an important legal concept that influences the security of real estate transactions involving subdivided properties. While it can provide lenders with greater security, it can pose challenges for borrowers. By understanding the intricacies of the map rule and by engaging in careful due diligence, clear communication, and professional guidance, both lenders and borrowers can navigate the complexities of this legal system and ensure a successful and secure real estate transaction.

Closure

Thus, we hope this article has provided valuable insights into The Map Rule Mortgage: Navigating the Complexities of Land Ownership. We appreciate your attention to our article. See you in our next article!