Unlocking the Secrets of Property: A Guide to Tax Map Number Lookups

Related Articles: Unlocking the Secrets of Property: A Guide to Tax Map Number Lookups

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unlocking the Secrets of Property: A Guide to Tax Map Number Lookups. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking the Secrets of Property: A Guide to Tax Map Number Lookups

Understanding the intricacies of property ownership can be a daunting task, particularly for those unfamiliar with the complexities of land records and legal descriptions. However, one crucial tool that simplifies this process and provides valuable insights into property information is the tax map number lookup.

Tax map numbers, also known as parcel numbers or assessment numbers, are unique identifiers assigned to each individual property within a municipality or county. These numbers are integral to the property tax system, acting as a vital link between physical land and the associated tax records.

The Importance of Tax Map Numbers

Tax map numbers serve as a cornerstone for efficient property management and administration. They provide a standardized and universally recognized system for:

- Property Identification: Tax map numbers ensure clear and unambiguous identification of individual properties, eliminating confusion and ambiguity often associated with traditional property descriptions. This is particularly crucial in densely populated areas with numerous properties.

- Tax Assessment and Collection: By associating a specific tax map number with a property, municipalities can accurately assess property values and determine the corresponding tax liabilities. This streamlined process ensures equitable distribution of tax burdens and efficient revenue collection.

- Land Records Management: Tax map numbers act as a central reference point for all property-related records, including deeds, mortgages, and other legal documents. This centralized system facilitates efficient record-keeping, retrieval, and updates, crucial for accurate property information management.

- Property Transactions: During property transactions, tax map numbers play a critical role in verifying the identity of the property being transferred, ensuring accuracy and minimizing the risk of errors. This simplifies the legal process and protects both buyers and sellers.

Unveiling the Information: Utilizing Tax Map Number Lookups

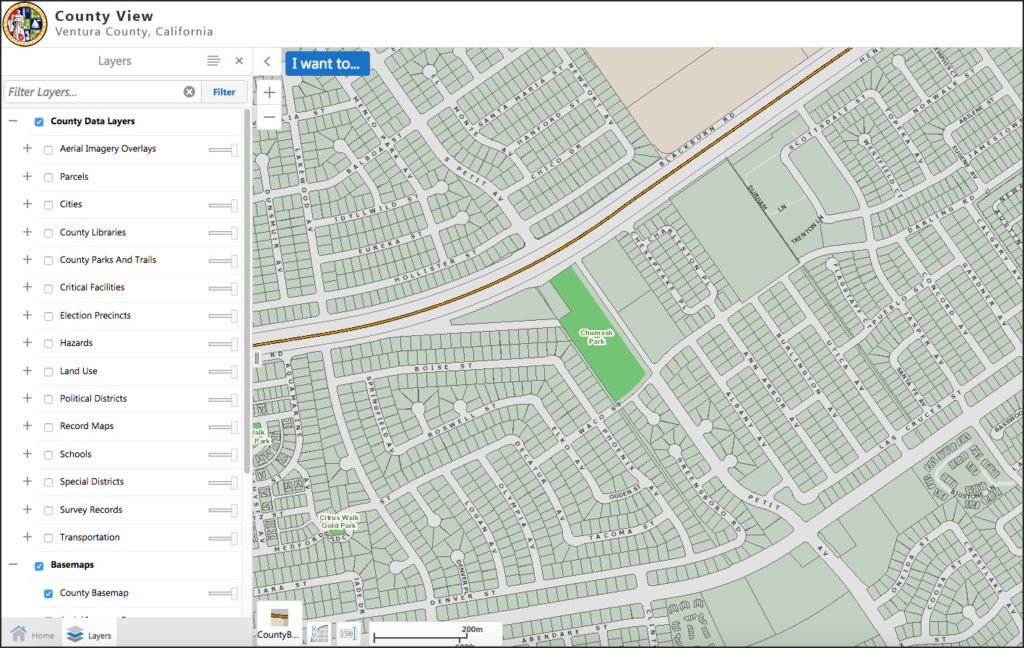

Tax map number lookups provide a gateway to a wealth of information about a specific property. Typically, these searches can be conducted through online portals maintained by local governments or private property data providers. The information retrieved through a tax map number lookup can include:

- Property Address: Identifying the street address associated with the tax map number, allowing users to pinpoint the property’s location.

- Property Size and Boundaries: Providing detailed information about the property’s dimensions, acreage, and legal boundaries.

- Property Ownership: Revealing the names and contact information of the current property owners, facilitating communication and legal procedures.

- Tax Assessment Details: Displaying the assessed value of the property, tax rates, and any outstanding tax liabilities.

- Zoning Information: Identifying the zoning classification of the property, indicating permitted uses and development restrictions.

- Property History: In some cases, tax map number lookups may provide a historical overview of the property, including past owners, transactions, and modifications.

The Benefits of Tax Map Number Lookups

Beyond simply providing property information, tax map number lookups offer a range of benefits for individuals, businesses, and government entities:

- Due Diligence: For prospective property buyers, tax map number lookups are an essential tool for due diligence. They provide crucial information about the property’s legal status, financial obligations, and potential risks, enabling informed decision-making.

- Property Management: Landlords, property managers, and real estate professionals rely on tax map number lookups to maintain accurate property records, manage tax payments, and ensure compliance with local regulations.

- Government Planning and Development: Municipalities and planning agencies use tax map number lookups to track property ownership, monitor development trends, and formulate effective land use policies.

- Property Research and Analysis: Researchers, historians, and genealogists utilize tax map number lookups to trace property ownership patterns, understand land use changes, and uncover valuable historical insights.

Navigating the Landscape: FAQs about Tax Map Number Lookups

1. How do I find the tax map number for a property?

Tax map numbers are typically assigned by local government agencies responsible for property assessment and taxation. You can usually find the tax map number on property tax bills, deeds, or other legal documents related to the property. Additionally, many municipalities provide online property search tools where you can enter an address or other property details to retrieve the corresponding tax map number.

2. What if I don’t know the exact property address?

If you lack the exact address, you can still find the tax map number by using other identifying information, such as the property’s legal description, a plat map, or even a nearby landmark. Contacting the local assessor’s office or land records department can also be helpful.

3. Are tax map numbers standardized across different jurisdictions?

Tax map numbers are specific to individual jurisdictions, meaning they may vary significantly between counties, municipalities, and even different states. Therefore, a tax map number from one jurisdiction is unlikely to be valid in another.

4. What if the tax map number lookup returns no results?

If a tax map number lookup returns no results, it could indicate a few possibilities:

- Incorrect Tax Map Number: Double-check the entered tax map number for accuracy.

- Property Not Registered: The property might not be registered in the tax system due to recent development, ownership changes, or other reasons.

- System Error: Occasionally, technical issues can cause errors in the search results. Try refreshing the page or contacting the relevant agency for assistance.

5. Are tax map number lookups free of charge?

Many online tax map number lookups are free of charge, provided by local government agencies. However, some private property data providers may charge fees for accessing their databases.

Tips for Successful Tax Map Number Lookups

- Start Local: Begin your search with the local government website or assessor’s office responsible for the property’s location.

- Check Multiple Sources: If one source doesn’t provide the desired information, explore other potential resources, such as property records websites, real estate databases, or public libraries.

- Contact the Assessor’s Office: If you encounter difficulties, don’t hesitate to contact the local assessor’s office for assistance. They are the experts on property records and can provide guidance.

- Be Patient and Persistent: Finding the right information can sometimes require patience and persistence. Don’t give up easily, and explore all available options.

Conclusion

Tax map number lookups are an indispensable tool for anyone seeking information about property ownership, tax liabilities, and other crucial details. By providing a standardized and reliable system for identifying properties, these lookups streamline property management, facilitate accurate record-keeping, and empower individuals with valuable insights into the legal and financial aspects of real estate. Understanding the power and functionality of tax map number lookups empowers you to navigate the complex world of property ownership with confidence and informed decision-making.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Secrets of Property: A Guide to Tax Map Number Lookups. We hope you find this article informative and beneficial. See you in our next article!